Post Code:511400

Email:sales@blaccessory.com

whatsApp:+86 18028696007

Launch delays burn cash. Bad batches burn trust. I want a supplier who ships right, every time, at a price that keeps my margins safe.

Pick a factory-backed wholesaler with stable quality, clear MOQs, tested materials, and predictable lead times. Verify certificates, run a pilot order, and lock terms in writing. Add backup options before you need them.

#cosmetic wholesale supplier selection, OEM ODM, factory audit

If you want fewer surprises and steady sell-through, keep reading. I will share my checklist from daily factory work. It is simple. It is practical. It protects dates, cost, and brand reputation without extra noise.

Which Type of Supplier Fits My Business Model?

Trading agents move fast. Factories control quality. I choose based on my real need, not pitch decks.

Decide between factory-direct, hybrid (factory + trading), or distributor. Map this to your SKU mix, customization level, and target MOQs. Factory-direct wins for custom bags. Distributors win for ready stock and speed.

#factory vs trader, wholesale cosmetics bags, supplier types

I start with my catalog plan. If 70% of my line needs custom logos, custom colors, or special windows like TPU, I go factory-direct. I want sample control and quick tool changes. If my line is 80% repeat stock, I use a distributor with local warehousing and stable replenishment. A hybrid partner helps when I want factory pricing plus a service team that handles small mixed cartons. I test response speed with a simple brief. I ask for a costed BOM, MOQ, lead time, and sample plan within 48 hours. I check legal entities and bank accounts. I prefer a supplier that can name their stitching line, show sewing machines on video, and list their upstream trim vendors. If they cannot explain zippers, linings, and label lead times, I know I will be the project manager for every PO.

| Type | Best For | Strength | Watch-Out |

|---|---|---|---|

| Factory-direct | Custom SKUs, logos | Process control | Higher MOQs on parts |

| Hybrid | Mixed MOQs, add-on services | Flex + speed | Fees for extras |

| Distributor | Fast stock | Short lead time | Limited customization |

How Do I Check Real Capacity and Lead Time?

A nice quote does not sew a bag. Real lines do. I seek proof before I trust dates.

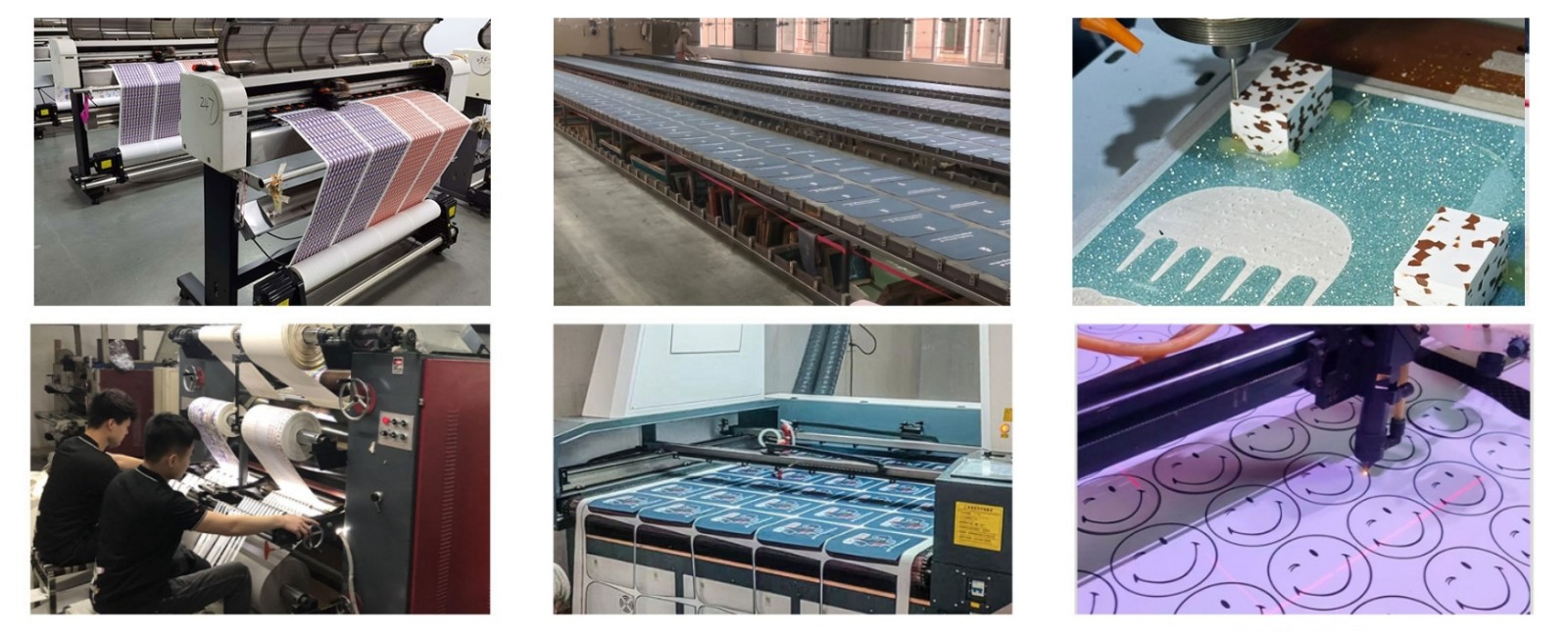

Ask for line photos or live video, operator count, and machine list. Confirm sample SLA and booked production windows by line. Validate last three shipment on-time rates and average PP-sample days.

#lead time verification, production line capacity, supplier vetting

I ask five things: How many sewing lines run per shift? Who owns sampling? Which operator group handles my material? What is the average PP-sample cycle? What is the pass rate on first inspection? I cross-check with a mini pilot: ten to twenty units with my real logo, zipper gauge, and lining color. I set two dates: PP sample handoff and mass production start. I also ask for holiday calendars and blackout weeks. I prefer suppliers who can pre-book a slot once I approve PP samples. For urgent launches, I use split shipments: air for launch quantities, sea for refill. If a supplier cannot give me a line ID and a window, they do not control their schedule. I move on because a late start costs more than a slightly higher unit price.

| Item | Target | Evidence |

|---|---|---|

| Lines and operators | Named line + headcount | Photo/video + list |

| Sample SLA | 5–10 working days | Calendar invite |

| PP to mass gap | ≤7 days | Booked slot proof |

| On-time rate | ≥95% last 90 days | Shipment records |

| Peak plan | Backup line | Email confirmation |

How Do I Evaluate Quality and Compliance Fast?

Beautiful photos hide weak seams. I want proof on paper and in hand.

Request recent test reports (colorfastness, AZO, phthalates), factory audits (BSCI/ISO), and a defined AQL plan. Inspect fabric, zipper gauge, stitching density, and logo method on real material. Run your own drop and rub tests.

#quality control, AQL cosmetic bags, compliance Prop 65 REACH

I keep a three-part check. Part one is documents: BSCI or ISO, and chemical test reports for recent batches. Part two is samples: I tug seams, open and close zippers 50 times, and rub logos with alcohol on a cotton swab. I do a five-drop carton test from waist height. Part three is process: I ask for an in-line QC photo at cut, at stitching, and at packing. I prefer an AQL table in the PI so we align on defect types and limits. I lock the BOM: fabric spec, lining, zipper model, slider type, puller finish, labels, and pack-out. When the supplier passes this gate, field complaints drop. When they argue about tests, I note that returns will cost more than tests. A good supplier knows this already.

| Area | What I Require | Why |

|---|---|---|

| Documents | BSCI/ISO, chemical tests | Retail acceptance |

| Stitching | SPI, bartacks | Durability |

| Zipper | #5/#8 coil, smooth run | User feel |

| Logo | Print/emboss proof | Brand look |

| Pack-out | Carton spec, labels | 3PL compliance |

How Do I Balance MOQ, Price, and Cash Flow?

Low MOQs help launches. Bad pricing kills margin. I pick a mix that protects both.

Negotiate tiered pricing with realistic MOQs by color and logo method. Batch shared trims to lower cost. Use pilot orders to test demand, then place a larger repeat with sea freight.

#MOQ pricing negotiation, tiered quotes, wholesale cosmetic bags

I ask for a three-tier quote: 300/500/1000 units per SKU, with adders for special pulls or metal logos. I split MOQs by colorway if bodies are shared. I standardize zippers and linings across SKUs to gain volume. I run a 100–300 unit pilot to test demand and QC at the same time. I ship that pilot by air to hit dates and use the data to size the sea order. I align payment terms to milestones: 30% deposit, 70% against passed inspection and draft BL. For cash flow, I stack launches in waves so I never sit on too much inventory. If the supplier refuses tiering or small pilots, I assume rigid capacity or weak cash health. I move on.

| Quantity | Unit Price | Notes |

|---|---|---|

| 300 | $X.XX + logo adder | Launch pilot |

| 500 | $X.XX | Core run |

| 1000 | $X.XX | Best cost |

| Shared trims | −$0.05 to −$0.15 | Same zipper/lining |

| Metal logo | +$0.20–$0.50 | Tooling amortized |

How Do I Control Logistics and Chargebacks?

Great production can still lose money in transit. I plan pack-out like a product.

Set a routing guide with carton sizes, weight caps, labels, and ASN rules. Use split modes: air for launch, sea for restock. Confirm pallet rules with your 3PL. Add a damage pilot before scaling.

#logistics for wholesale, routing guide, carton optimization

I write a one-page routing guide. It includes carton dimensions, gross weight limit, inner pack counts, barcode label size and location, and pallet pattern. I send it with the PO. I ask for two pilot cartons to run a drop test and 3PL intake. I choose DDP air for launch dates that cannot slip, and sea LCL/FCL for replenishment. I track ASN accuracy; missed scans become chargebacks. I also add simple carton art with orientation arrows and “do not crush” zones. When a supplier follows this guide, 3PL receiving speeds up, and my landed cost stays honest. If they refuse to follow the guide, I budget extra fees or choose a partner who will.

| Item | Target | Impact |

|---|---|---|

| Carton size/weight | Fit shelf + 3PL caps | Lower freight |

| Labels & ASN | GS1/retailer rules | Avoid chargebacks |

| Pallets | Pattern + wrap spec | Fewer damages |

| Split mode | Air launch, sea restock | Cost + date control |

| Pilot drop test | Two cartons | Proof before scale |

How Do I Lock Terms and De-Risk the Relationship?

Handshake deals fail under pressure. Clear terms keep friends friendly.

Use a Purchase Agreement that covers confidentiality, IP on designs and molds, payment terms, AQL, rework windows, and after-sales support. Add a backup supplier and shared BOMs to switch fast.

#supplier agreement, IP protection, dual sourcing

I keep a short but strong agreement. It lists who owns the tooling and files, how we handle rework when defects exceed AQL, and how long the supplier must keep BOMs and material lots. I include a confidentiality clause for artwork and retailer programs. I attach the routing guide and QC plan as schedules. I also run a “shadow” onboarding for a second supplier using the same BOM and art files. I place a small PO there to keep them warm. If demand jumps or a holiday slows the main line, I open the valve. I store everything in one shared folder: CAD, Pantones, zipper codes, labels, and carton specs. When teams change, the files do not. Launches stay on time.

| Clause | Why It Matters | Tip |

|---|---|---|

| Tooling ownership | Protects your molds | Add buy-back terms |

| AQL + rework | Clear defect path | Define windows |

| IP & NDA | Protects artwork | Include penalties |

| Data retention | Traceability | Lot codes in PI |

| Backup supplier | Capacity safety | Share BOMs early |

Conclusion

Pick supplier type first. Prove capacity and quality with a pilot. Balance MOQs with tiered pricing. Lock logistics in a routing guide. Sign clear terms and keep a warm backup. That is how launches stay on time.

Cosmetic bag manufacturers, custom cosmetic bags, cosmetic bag factory, bulk canvas cosmetic bags, wholesale bulk cosmetic bags, beauty, skin, PVC.

Hair Accessories: Hair ties, hair clips, headbands, and hairbands. Chic, stylish, suitable for any occasion.

Copyright © 2025 Bling Accessory Co., Ltd. | All Rights Reserved.